Life insurance is a powerful tool to ensure that your loved ones are taken care of financially after you’re gone. But as life evolves, so do our relationships and priorities. A common question we encounter is: “Can I change the beneficiaries on my life insurance whenever I want?” Our Olney will and trust attorneys dive into that answer below.

The Short Answer: Yes, You Can

Life insurance policies are designed with flexibility in mind. If you own the policy, you generally have the right to change your beneficiaries at any time, for any reason.

The Process

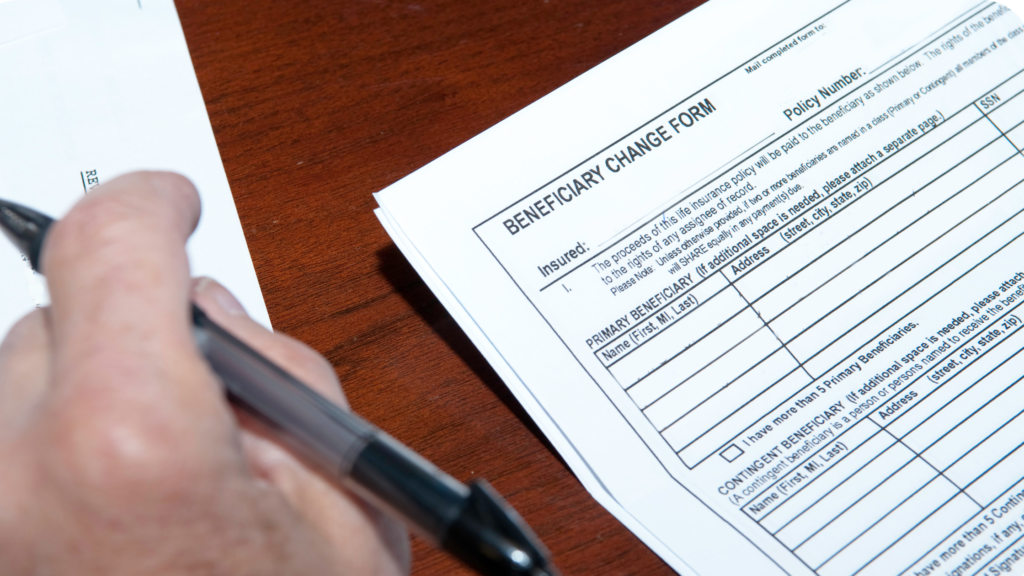

Changing beneficiaries is typically straightforward. Most insurance companies require you to fill out a “Change of Beneficiary” form. Once completed and returned, the changes are usually processed quickly. Always request a confirmation of the change and keep it with your important documents.

Multiple Beneficiaries

You’re not limited to naming just one beneficiary. You can designate multiple beneficiaries and specify the percentage of the death benefit each one should receive. This flexibility allows you to distribute your policy’s proceeds in a way that aligns with your wishes.

Regular Reviews Are Key

It’s a good practice to review your life insurance beneficiaries regularly, especially after significant life events like marriage, divorce, the birth of a child, or the death of a beneficiary. This ensures that your policy remains aligned with your current wishes.

Considerations and Restrictions

While you have the freedom to change beneficiaries, there are a few considerations to keep in mind:

- Irrevocable Beneficiaries: If you’ve designated someone as an “irrevocable beneficiary,” you’ll need their consent to make changes.

- Divorce Decrees: Some divorce agreements may have stipulations about maintaining a former spouse as a beneficiary. Always consult with an attorney if you’re unsure.

- Minor Children: If you’ve named a minor child as a beneficiary your family will be subject to the probate process and your beneficiaries inheritance may be subject to court oversight until they are 18.

The Importance of Clear Designations

To avoid potential disputes or confusion, be as specific as possible when naming beneficiaries. Instead of using generic terms like “my children,” use their full names and how you would like the proceeds to be divided.

The Role of Trusts

If you have concerns about how a beneficiary will handle the money or your beneficiary is a minor, consider setting up a trust. Trusts can provide more control over how and when the death benefit is distributed.

Conclusion

Your life insurance policy is a dynamic tool that can be adjusted as your life changes. While you have the flexibility to change beneficiaries, it’s essential to do so thoughtfully and with a clear understanding of any potential implications.

If you have questions about changing beneficiaries or need guidance on optimizing your life insurance for your current circumstances, our Olney will and trust attorneys are here to help. Simply call us at (240) 813-8843 or schedule an appointment here.